Geico Bonuses

BONUS PAY: GEICO offers superb bonuses to team members who excel in their field of work, provide extraordinary results for GEICO, and encourage others to do the same. CHILDCARE DISCOUNT: GEICO cooperates with partners and team members are eligible for first-class discounts for a primary childcare. GEICO recently posted a combined ratio of 93.7, which is relatively strong (and profitable) when compared to its peers. At the same time, it shows that, with an operating profit of 6.3 cents for.

2,322 reviews from GEICO employees about Pay & Benefits. The pay and the benefits are great along with bonuses but its not worth the anxiety and the stress that. Geico refer a friend discount promo is one of the best you can find being advertised by any insurance company. Recently on ampminsure, a claims adjuster working with Geico Insurance said that their company is running a referral program for employees only where they are paid to only get people to make a quote.

GEICO is the second-largest auto insurance company in the U.S., with over 17 million policies under its belt. The company also offers renters insurance, homeowners insurance, boat insurance, and much more.

Geico Bonuses

If you’re in the market for a new insurance policy or are looking to learn more about how GEICO works, you’ve come to the right place.

In this post, let’s take a look at GEICO’s most popular products: auto and home insurance.

What is GEICO?

GEICO, which stands for Government Employees Insurance Company, has an interesting history. The company was founded in 1936 by husband-and-wife team Leo and Lillian Goodwin. In the early years, their focus was providing auto insurance to government employees. By the 1960s, their customer base grew to over 1 million. In 1980, they were one of the first insurance companies to provide 24/7 customer support over the phone—a feature that they still offer to this day.

In 1995, Berkshire Hathaway was so impressed with GEICO’s growth that it decided to acquire the business. The famous GEICO Gecko was introduced in 1999. Two decades later, the company now insures over 28 million vehicles. GEICO is headquartered in Chevy Chase, MD, and employs over 40,000 people—with 18 regional offices located throughout the U.S.

Now that I’ve covered the nuts and bolts of the company, let’s take a look at how GEICO’s insurance policies work.

GEICO Car Insurance

If you drive a car, you’ve probably considered signing up for GEICO car insurance at some point. Here are the main features that GEICO offers when it comes to auto insurance:

Basic Liability Coverage

If you’re looking for the cheapest auto insurance plan out there, GEICO’s basic liability coverage might be a good option. Basic liability includes the following coverages:

- Bodily Injury Liability, which pays for expenses related to an injury due to an accident that you caused.

- Property Damage Liability, which pays to repair any damage you cause to another person’s vehicle or property.

Medical Coverage

GEICO offers the following types of medical coverage on their auto policies:

- Medical Payments Coverage, which pays for any medical expenses that result from an accident.

- Personal Injury Protection (PIP) pays for any medical treatment that you might need as a result of an accident. If you aren’t able to work, PIP might also cover your expenses due to lost wages.

Uninsured/Underinsured Motorist Coverage

Unfortunately, millions of drivers hit the road each day without insurance. GEICO’s uninsured/underinsured motorist coverage will pay to repair your vehicle if another driver causes an accident and doesn’t have insurance.

Comprehensive Coverage

GEICO’s comprehensive coverage pays for your car to be repaired or replaced for non-accident-related incidents, like vandalism, theft, flooding, or fire.

Collision Insurance

As the name suggests, collision insurance pays for car repairs due to an accident you cause. For example, if you accidentally back up into a lamppost, your repairs would likely be covered by collision insurance—after satisfying your deductible.

Additional Coverages

GEICO offers several additional auto insurance add-ons beyond typical insurance coverage, including emergency road service, rental reimbursement, and mechanical breakdown insurance.

GEICO Mobile App

Using the GEICO app, you can pay your bills, view policy documents, contact customer support, sign up for a new policy, submit a claim, and more. You can even use the app to request roadside assistance if your car breaks down.

GEICO’s mobile apps are extremely well-rated. The iOS app has a 4.8-star rating (out of 5) in the App Store, with over 1.8 million reviews. It’s ranked 16th among all finance apps.

The GEICO app is also rated at 4.8 stars (out of 5) in the Google Play Store. With these types of numbers, it’s obvious that GEICO has heavily invested in making its apps user-friendly.

GEICO Home Insurance

GEICO’s home insurance plans will pay to repair your home if it is damaged by a fire, flood, or other natural disasters. Your personal belongings will also most likely be covered in the event of a burglary. Most mortgage lenders require you to have home insurance in order to get a loan, so if you own a home, chances are you’re already a home insurance customer.

Here are some additional features offered by GEICO’s home insurance policies:

- Property damage will be paid for due to damage from fire, flood, wind, or hail

- Furniture, appliances, and electronics will be replaced if stolen or damaged

- Specialized jewelry insurance is available for more valuable items

- Personal liability coverage might pay for legal expenses if you are sued by someone due to an injury they sustained on your property or in your home

- Relocation and temporary housing expenses might be covered if your home is uninhabitable during a major repair

Pricing & Quotes

GEICO has a reputation for being one of the least expensive insurance providers.

Their sheer size and scale enable them to offer competitive pricing without skimping on coverage benefits.

GEICO Sign Up Process

To sign up for GEICO car insurance, you’ll first enter your zip code. Next, you’ll have to enter your contact information, including first name, last name, address, date of birth, and email address.

The next step is entering your vehicle details, including the make, model, and estimated annual mileage usage of your car.

You’ll then have to enter additional details about the primary driver, including if the driver is married, the level of education that the driver has received, and what the driver’s occupation is. These details are most likely required because insurance rates tend to be lower for people that are married, educated, and employed.

On the next step, GEICO asks for details about your driving history. If you’ve been charged with a DUI or gotten into an accident in the past few years, this is most likely going to increase the cost of your insurance plan.

After entering your driving history, GEICO asks you to confirm whether or not you currently have insurance. After you do that, you can submit your quote for processing and should receive an email with information on the next steps shortly thereafter. The whole process was pretty painless and only took me a few minutes to get a quote.

To sign up for home insurance, the first step is entering your zip code.

You’ll then have to enter your address and contact information:

Once GEICO’s website verifies your address, you’ll be prompted to enter some important details about your home—like when it was built, what type of roof and siding it has, and how many stories it has.

/arc-anglerfish-arc2-prod-dmn.s3.amazonaws.com/public/QLB3FDMTNRCAPJG4SGAFU6GMVU.jpg)

After that’s done, your quotes will be ready for review. You might have to enter your Social Security number to verify your identity, but that should be the last step. Pretty easy, right?

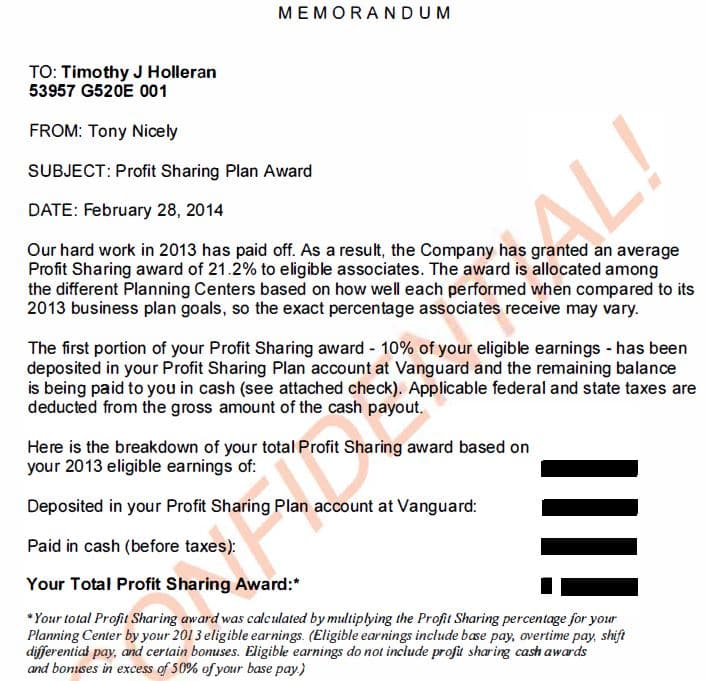

Promotions, Bonuses, Coupons

GEICO doesn’t offer any special coupons or bonuses. However, you can get a discount by bundling together several types of insurance. In the screenshot below, you can see they are pushing you to bundle home and auto insurance together, which is a common tactic among the larger insurance providers.

Security Features

GEICO’s website is protected by SecureTrust, which is an online service that protects your personal and credit card data using a 256-bit SSL security certificate.

Customer Service and Support

GEICO seems to take pride in offering round-the-clock customer support. As you can see in their contact us page, they have phone agents standing by 24/7. You can also contact customer support in the GEICO mobile app, by sending them an email, or by chatting with them on Twitter.

Pros and Cons of GEICO Insurance

Geico insurance has several advantages and some disadvantages as well.

Pros

- Impressive mobile apps make it easy to access your account on-the-go

- 24/7 customer support is a huge bonus

- Competitive pricing; one of the lower-cost insurers

Cons

- Loan/lease payoff insurance (also known as gap insurance) is not available

- Some people have reported sharp rate hikes after an accident

Alternatives to GEICO

Some of the larger insurance alternatives to GEICO are:

In terms of pricing, Progressive is probably going to be the closest alternative.

FAQs

Here are answers to some of the most frequently asked questions about GEICO Insurance:

Is GEICO Good Insurance?

Yes. GEICO is a good insurance company. GEICO offers solid customer support and a wide range of insurance coverages.

Is Progressive or GEICO Better?

Both Progressive and GEICO are good insurance companies that offer similar plans and pricing. If you’re debating which company is the better choice for you, I recommend signing up for free quotes from both providers.

Is GEICO Really Cheaper?

GEICO is most likely going to be cheaper than Allstate or State Farm. However, their rates are probably going to be close to what Progressive offers. The only way to get an accurate price is to sign up for a free quote.

Geico Bonus

What is GEICO’s Rating?

GEICO has an A+ rating from the Better Business Bureau and a 3.8-star rating from Consumer Affairs. Considering how many customers they have, I would say that these ratings are pretty good.

Is GEICO Right for You?

If you own a car or a house, signing up for insurance is an unavoidable obligation. Considering GEICO’s competitive pricing and accessible customer service, I would definitely recommend seeing how their rates compare with your current insurance provider. It’s also not a bad idea to shop around for new insurance plans every few years in order to make sure you’re getting the best deal.

At the end of the day, there’s not a single “best” insurance company out there. It’s all about finding a plan that fits within your budget and protects the things you value.

Here’s to getting the best rates on your insurance coverage—and to avoiding accidents in the first place, so you don’t ever need to submit a claim.

GEICO Insurance

Bottom Line

GEICO offers affordable insurance coverage for your car, home and much more.

Pros

- Easy-to-Access Mobile App

- 24/7 Customer Support

- Competitive Pricing

9.5

Geico Employee Bonuses

9.5

10.0

Geico Bonus Drive

10.0